I have been engaging with WSB (/r/WallStreetBets) since 2014.

Every regular person on WSB understands it’s a game. You can loose it all, make it big, sometimes both in the same day — it’s all a game. The most accurate assessment of WSB culture was clearly:

Like 4chan found a Bloomberg Terminal.

While the influx of new users may change the community, prior to January 15, 2021 the above was indeed an accurate description.

Stop the Game with GameStop

Honestly, this world feels like we are in a simulation. The company GameStop appears to be poised to bring down the entire financial system — stopping the game.

The infinity squeeze appears to be coming, what is an infinity squeeze you ask? It’s a really massive short squeeze:

A short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock’s price.

Short positions can technically lead to infinite losses. Simply put, if I open a short position for $10 and the share price drops 10%, I make $1. However, if the stock price increases say 10,000% I now owe $1,000.

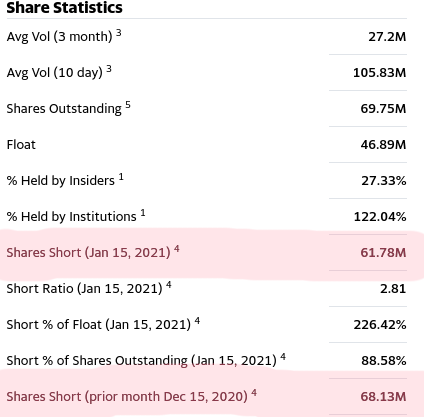

In the case of GameStop, the situation appears dire. At one point the short positions were 140% of available shares of the market. This means that more shares were lent out than were available on float, i.e. shorts were resold / lent several times. At this point, several things are happening[1]:

- Those holding short positions are paying ridiculously high interest rates

- If the short positions were forced to close, it would cause a major loss to multiple hedge funds (tens of billions total & bankrupcies)

- Due to the level of shorting, exiting the short positions would be excessively expensive and cause a short squeeze

- There is less GameStop stock available for purchase

- The price of GameStop stock is rising

As a result, it appears to me that:

- Short holders cannot exit their positions without going bankrupt

- Short holders are being hit by high interest rates

- Closing other positions in the stock market should help them cover the interest rates

- Best option for short position holders is is to wait & pray the stock price drops

- What happens if not enough people are willing to sell?

Personally, I believe all of this will suck all the liquidity from the stock market. Either those shorting suffer the loss and close their positions or wait as the stock continues to stay high… in either case hundreds of billions of dollars is leaving the market.

How did we get here?

Infinity Squeeze – Short Positions

There’s a lot to this story I’ll come back an fill in, but the gist is this — In mid-January 2021 GameStop was extremely shorted.

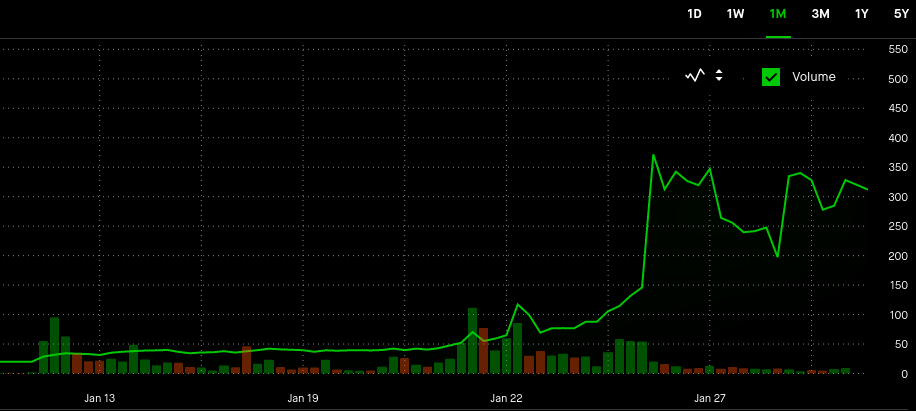

The massive short position and didn’t go unnoticed, WSB had been discussing it for months. That being said, the massive spikes in purchases did not start until January 12:

What happened at that time? The YOLO updates definitely started at that time and stocks started to rise. Once the stocks started to rise, I believe institutions and WSB itself started piling into GameStop. The stock started to move and if they could get in they could make a boat load. It’s important to remember WSB is often visited by hedge fund mangers, CEOs, day traders big and small, etc. It’s not always the little guy(s). When they piled in, the price started to rise further.

Infinity Squeeze – Let’s Make Money

As they purchased, I personally believe some short sellers managed to exit their positions (about 7m shares, per Yahoo Finance data)

What this indicates to me is that many of those holding short positions did not realize what was about to happen. They kept holding believing this was a classic pump-and-dump. Even WSB at the time didn’t not necessarily think about much besides making money. I know I even purchased call options during this week, particularly when the new data came out January 15, 2021. To me, it became clear the stock was about to rocket.

Infinity Squeeze – Let’s Stick it to the Man

In light of the massive number of short position(s) open in January 15, 2021, WSB realized they could (a) make money and (b) stick it to the hedge funds. Frankly, WSB have been waging a war on short selling for years. With GameStop they had a company with relatively few shares in float (47m), a low market cap, basically something that purchases would have an outsized impact.

I’m not 100% sure this was intentional, but as people started buying and holding waiting for the squeeze the stock started to rise.The rising stock both led to discussions on news outlets and the stock started going viral on social media platforms outside of WSB – further raising the going rate for a share of GameStop.

Those holding short positions did not want to sell as they’d lose money, so they were searching for capital to cover their leveraged positions. Citadel and Point72 partners appears to have come to at least one short sellers aid. This showed they were weak and further emboldened the WSB folks – “Let’s make some money on the hedge funds behalf”

Purchases from Jan 19 to Jan 23, 2021 and the stock price increased exponentially as it went viral:

Infinity Squeeze – The Rebellion

On January 27, 2021 across the board buying for GameStop was restricted (along with multiple other stocks) across various trading platforms. This effectively forced purchase volume lower and as users of these platforms could only sell it drove down the share price. This likely startled many GameStop shareholds and many liquidated their positions, letting the short sellers exit some of their positions. Through January 29, 2021 the ability to purchase in an unrestricted manner has not been restored.

What happened?

Personally, I’m of the opinion that there was not enough shares to go around and likely these platforms colluded to drive down the stock price. What’s more interesting is how few people sold. As of January 29, 2021 the price of a GameStop share was back at $325. This has led to some very VERY strong backlash and I know I’ll be joining a lawsuit at some point (if not filing my own), as this collusion cost me tens to hundreds of thousands of dollars.

One essay that particularly struck me was made on WSB: An Open Letter to Melvin Capital, CNBC, Boomers, and WSB

I recommend reading the comments on this essay to really get an under standing of what’s happening. Look at the charts. This is personal now. The market manipulation is obvious and people want revenge. For the current events, for 2008, for the entire corrupt system. They want to send a message. This is a protest.

Many retail investors will hold until the bitter end.

Many retail investors will hold until the bitter end.

Infinity Squeeze – End Game

So what happens next?

- Starting on January 27-29 people were trying to transfer funds off Robinhood and the other platforms which disabled purchasing of GameStop shares.

- Come the first week of February these assets will be again available and can be used to purchase GameStop shares.

- Everyone saw much fewer shares being traded Friday

- Everyone is talking with their families

- People are going to purchase more GameStop shares & hold

- I expect many are going to pull their assets out of the stock market

There are some unknowns, for instance have the short positions been closed? Have there been backroom deals to stave off the infinity squeeze?

If neither of those assumptions above hold, then what happens when the price rises further and there’s not enough shares for sale?

Hedge funds either bleed out as they pay the massive interest rates on holding those short positions or they will close their short positions causing an infinity squeeze (GameStop shares will be priced in the thousands). In either case hundreds of billions would likely leave the market.

Conclusion – The Black Hole

It’s a Nash Equilibrium, essentially the share holders have every reason to ask the maximum amount they can get for a share of GameStop (i.e. make money). If for some reason these GameStop share holders are unwilling to sell at a low rate, then these hedge funds stand to lose hundreds of billions and will go bankrupt (slowly via interest payments or quickly via short squeeze). To try and pay for their debts, they’ll have to sell off market wide and the entire market collapses.

There are three ways to alleviate the issue:

- GameStop issues a massive number of new shares

- Market manipulation (such as Robinood and friends only enabling selling – of course that didn’t work last time)

- Government settles the matter by confiscating shares

Personally, I view government involvement as inevitable. They could settle everyone accounts fairly by giving everyone the current share price or what they bought it for, which every is higher. That being said, I suspect the more likely course of action is some flat rate $100/share or something to that effect. In either case, if they don’t get involved, I suspect the system really will collapse.

Unless of course, I am wrong. I am not a financial expert and nothing in this article should be taken as advice.

It’s completely possible I’m inaccurately reading the situation and those shorting GameStop have already exited their position(s) and GameStop is currently just in a classic bubble.