The world has entered one of the hardest times since 2008, it will likely dwarf 2008, as we wont be able to print our way out of it.

That may be a bold statement, but it appears inevitable. In my view, there are simply too many indicators, we’re going to enter a time of Stagflation, and depending how our government handles the situation it could make a bad situation worse.

Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e. inflation). Stagflation can also be alternatively defined as a period of inflation combined with a decline in gross domestic product (GDP).

Employment

The economic recovery from COVID-19 is lower than expected. At this point, it appears as many as 5-7% of people have left the workforce since February 2020[1].

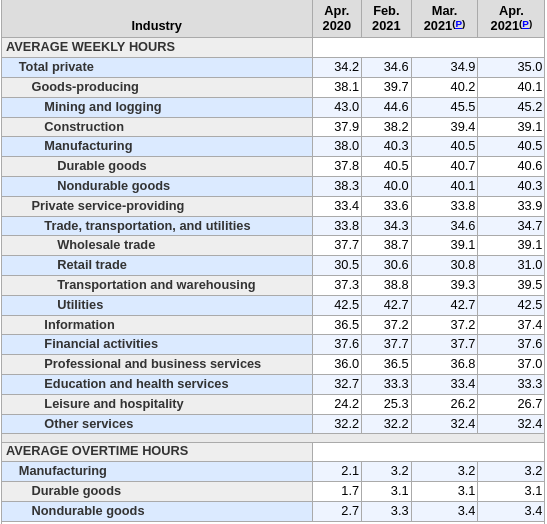

It’s also clear that the average number of hours worked has not significantly changed since April 2020[2].

It’s also clear that the average number of hours worked has not significantly changed since April 2020[2].

What this amounts to is a 5-7% reduction in GDP. It means less goods we can buy and less goods we can sell domestically. What about importing goods?

What this amounts to is a 5-7% reduction in GDP. It means less goods we can buy and less goods we can sell domestically. What about importing goods?

Global Trade

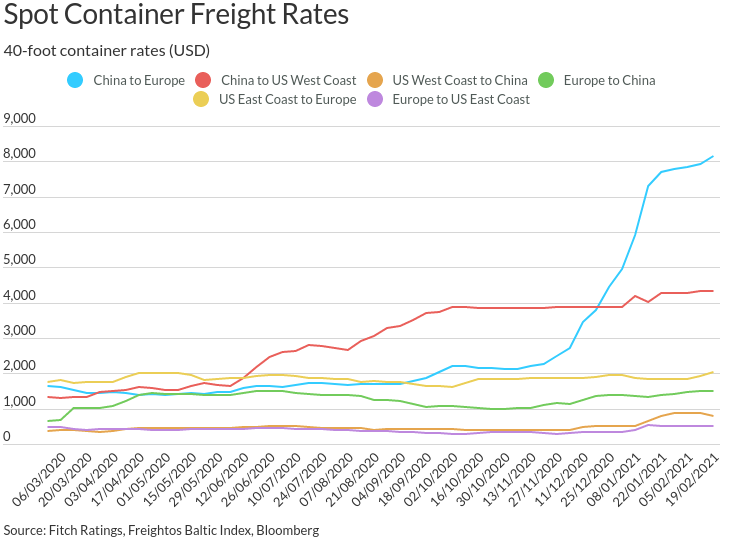

In recent months, the cost of importing goods from China is skyrocketing[3], up 400% from China to the USA and 800% from China to the EU.

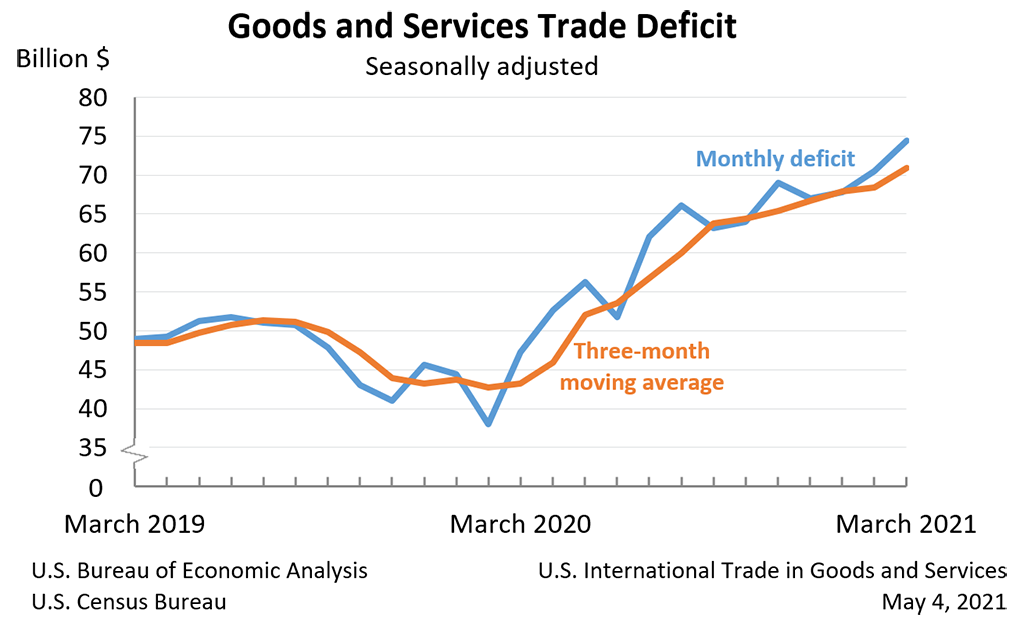

Essentially, the USA and EU has been importing more than China has been purchasing, so the containers are piling up. This has a secondary effect, China is gaining materials and wealth, but not purchasing as much from the USA and EU (based on historic trends). This can be seen in the trade deficits[4], which has increased 50% since February 2020.

Essentially, the USA and EU has been importing more than China has been purchasing, so the containers are piling up. This has a secondary effect, China is gaining materials and wealth, but not purchasing as much from the USA and EU (based on historic trends). This can be seen in the trade deficits[4], which has increased 50% since February 2020.

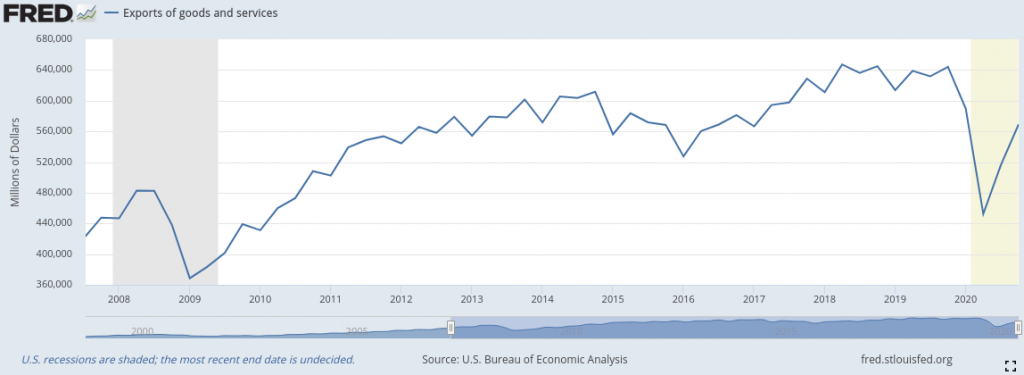

Ultimately, this could be a product of reduced output from the EU and the USA. Less goods being sold overseas, simply because there are less goods being produced. It appears there was a 15% reduction in exports from Q4 2019 to Q1 2021.

Ultimately, this could be a product of reduced output from the EU and the USA. Less goods being sold overseas, simply because there are less goods being produced. It appears there was a 15% reduction in exports from Q4 2019 to Q1 2021.

Raw Materials

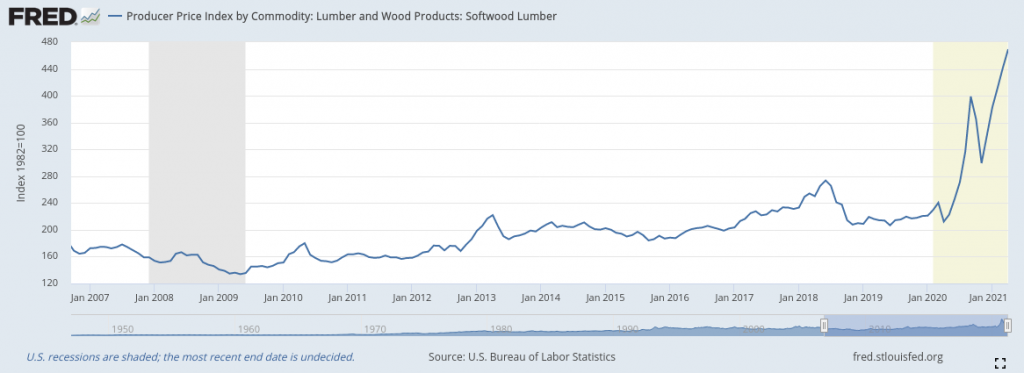

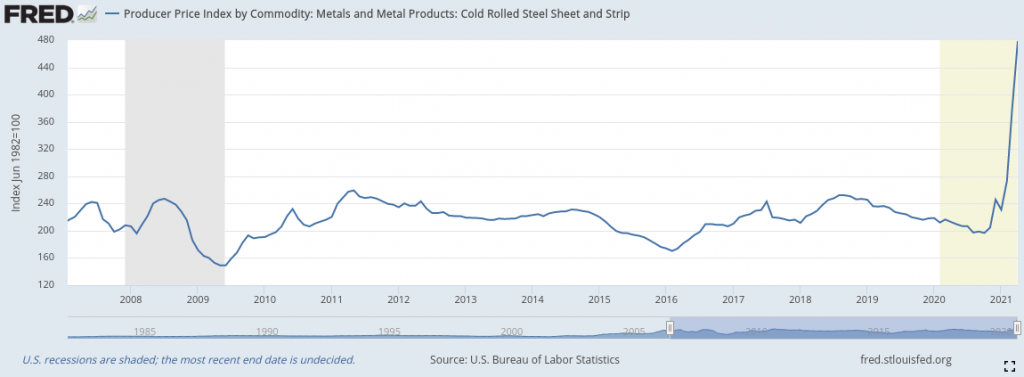

This also likely increases the costs of raw material and in turn any construction related projects or manufacturing.

Plastics & Resins are 25% from February 2020

Lumber is up 250% from February 2020

Copper is up 25% from February 2020

Steel is up 100% since February 2020

Food Prices

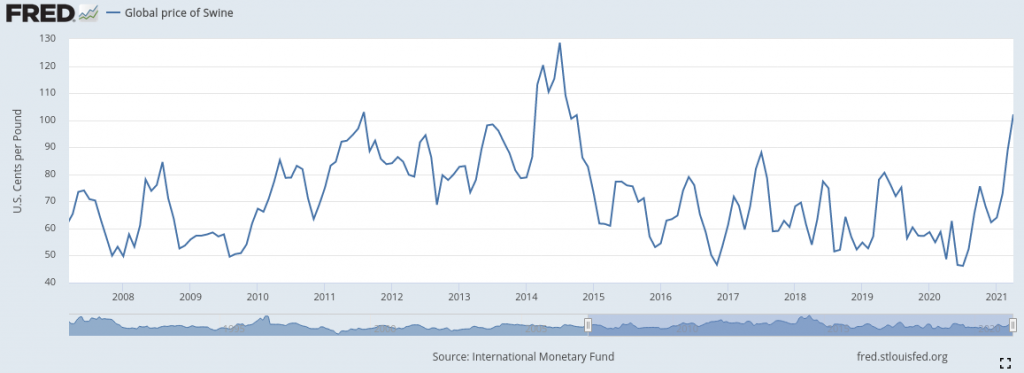

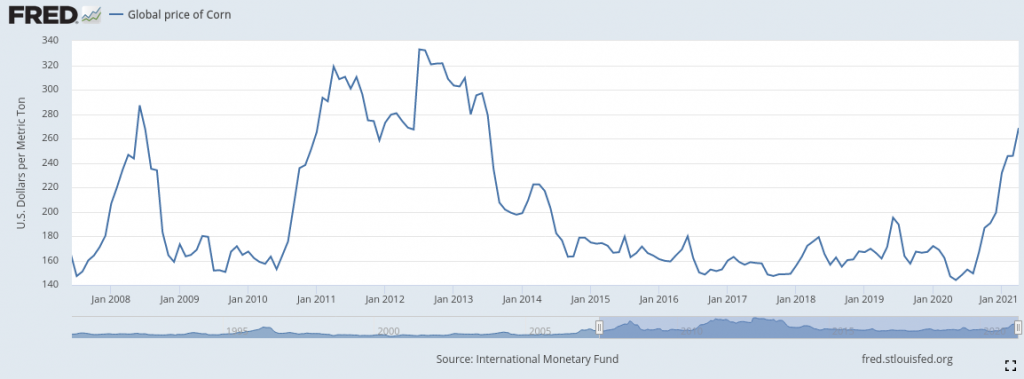

Not only are the cost of materials increasing, but food as well.

Swine prices are up 30% from February 2020.

Corn prices are up 75% from Q1 2020.

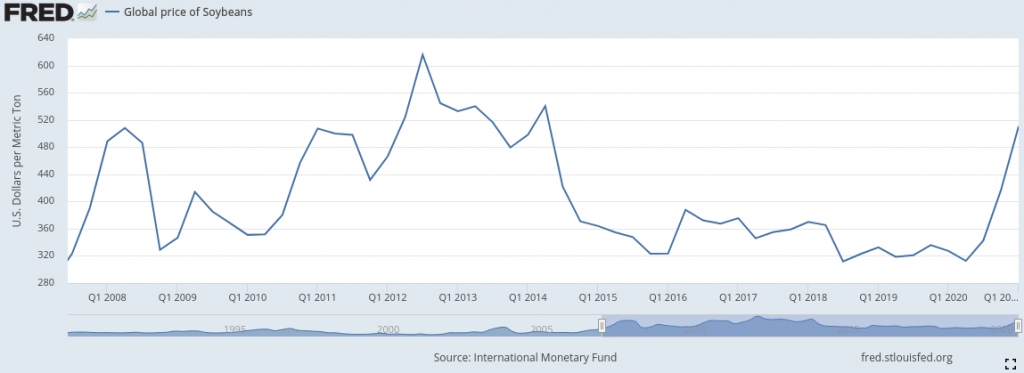

Soy prices are up 65% from Q1 2020.

Soy prices are up 65% from Q1 2020.

Wheat prices are up 40% from Q1 2020.

Wheat prices are up 40% from Q1 2020.

Money Machine Goes BRRRRR

To assist the population of the USA get through the COVID-19 pandemic, the government issued a massive amount of stimulus checks and purchased a massive amount of corporate debt. To manage this, the money supply was expanded (not going to cover here).

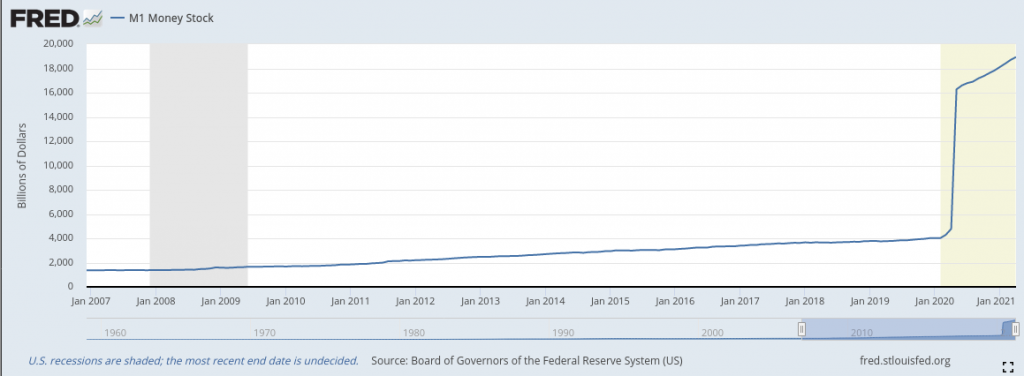

There was a 500% increase in the M1 money (coins and currency in circulation) stock since February 2020 (note the increased growth rate).

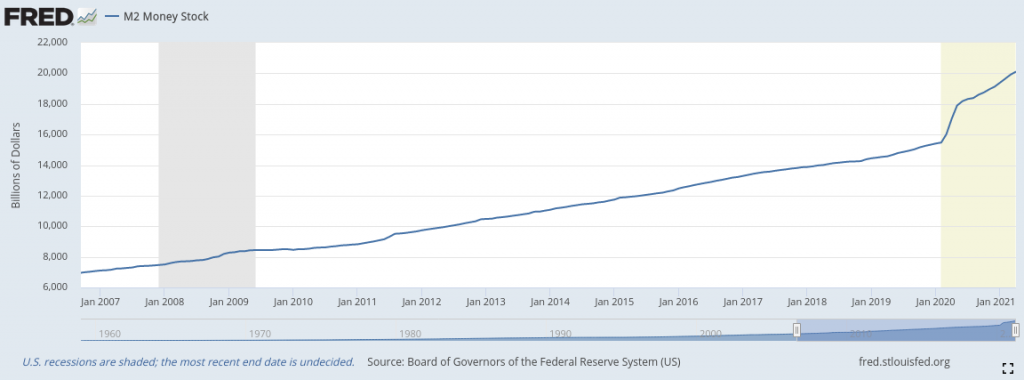

There was a 30% increase in the M2 money stock (coins and currency in circulation and deposits) stock since February 2020 (note the increased growth rate).

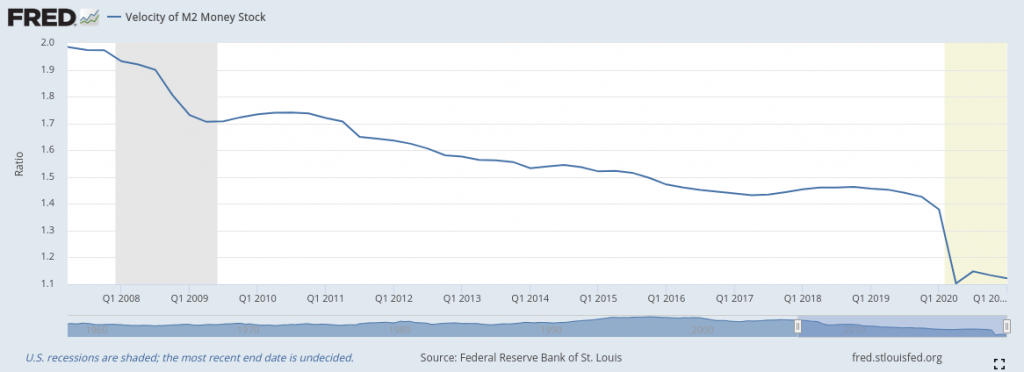

Effectively, this means that more currency is in savings accounts. It’s also clear, that velocity of the m2 money stock is not increasing and is down 35% since Q1 2020, i.e. people aren’t spending money.

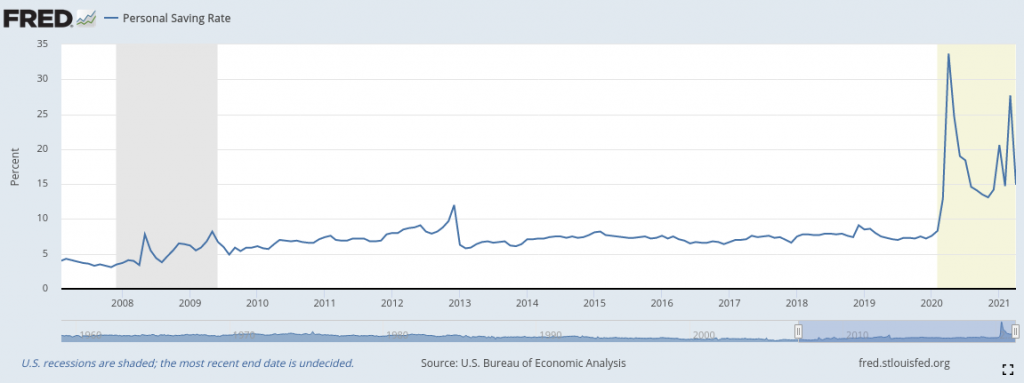

What does this amount to? People have more money in their savings accounts, the personal savings rate is up 120% since February 2020.

What this amounts to, is a massive increase in the Feds balance sheet.

Monetary Inflation & Economic Depression

The input costs to manufacturing, construction, food in the USA has increased significantly, potentially doubled.

- Transportation costs from Asia to the USA is up 400%

- Raw materials are up anywhere between 25% to 400%

- Food prices are up 40% to 50%

At the same time the input costs are increasing dramatically, there is more money being injected into the system in the form of checks to people and the government buying junk corporate bonds. This means consumers and producers are more capable of pruchasing items at the more expensive rate (setting a new market price); at least until the federal government turns off the money printer (which will be very painful).

The USA is also reducing it’s overall output.

- Employment is down 7%

- Exports are down 15%

- Small businesses closed (unknown)

- People are saving more (up 120%)

Generally, this means, less revenue to businesses at the same time the cost of doing businesses in skyrocketing.

Baring some major interventions soon, I don’t see any way out of inflation (it’s already here) and an economic depression.