In February 2022 I wrote an article discussing the prospects that Rumble, merging with a SPAC CFVI was a decent opportunity.

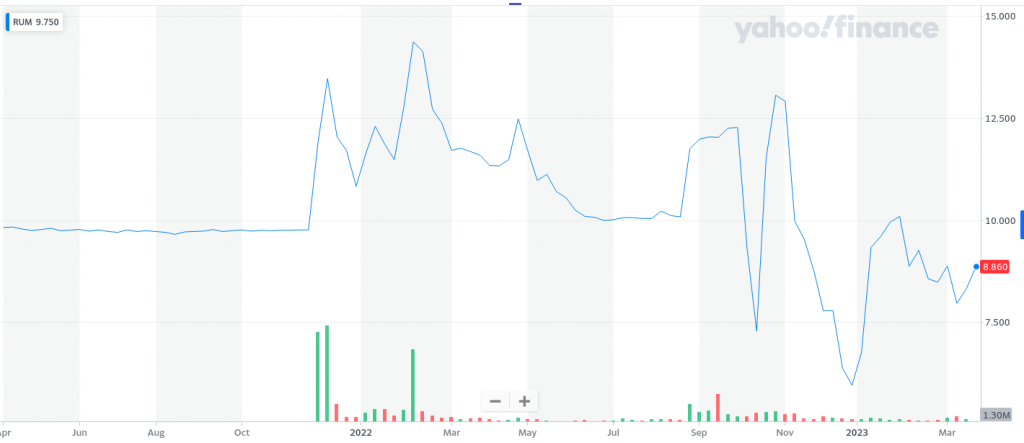

Since it’s launch it has been up-and-down (from finance.yahoo.com)

Overall, at time-of-writing it is down around ~30% since launch. That said, there are some very interesting statistics.

Overall, at time-of-writing it is down around ~30% since launch. That said, there are some very interesting statistics.

Financials

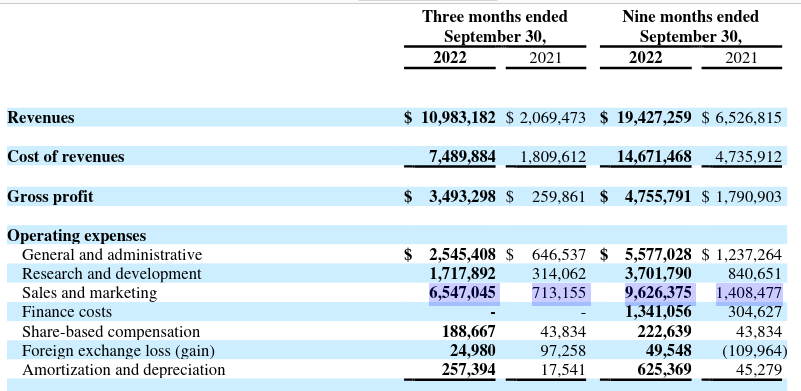

Again from Yahoo Finance, in Q3 2022 it appears Rumble has a total revenue of $11m – very low numbers for the $2.2B valuation at the time.

The cost of that revenue was $7.5m and the operating expenses were a whopping $11.25m — meaning the company lost $7.76m for the quarter. That said, per the rumble earnings, most of those costs appear to be “sales and marketing”. My personal assumption is they were on boarding new talent.

The cost of that revenue was $7.5m and the operating expenses were a whopping $11.25m — meaning the company lost $7.76m for the quarter. That said, per the rumble earnings, most of those costs appear to be “sales and marketing”. My personal assumption is they were on boarding new talent.

All that being said, it does appear to be working…

All that being said, it does appear to be working…

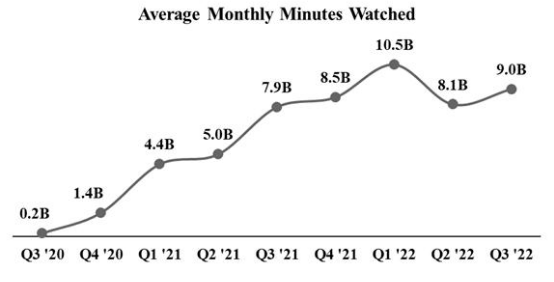

User Growth – 2022

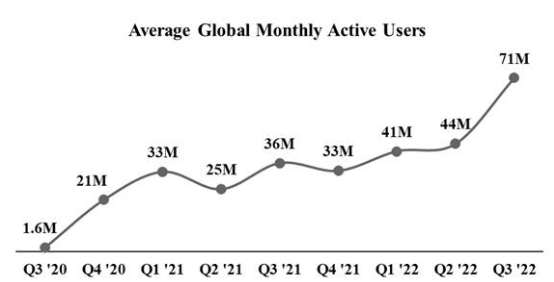

Although it may be expensive to start an online video platform, there are a few interesting statistics about Rumble.

The user growth from Q3 2020 to Q3 2022 was quite impressive, the monthly active users in Q3 2022 was 71 million (in comparison in 2022, YouTube had 2.1B monthly active users). This makes the monthly active user base of Rumble as 3.4% the size of YouTubes.

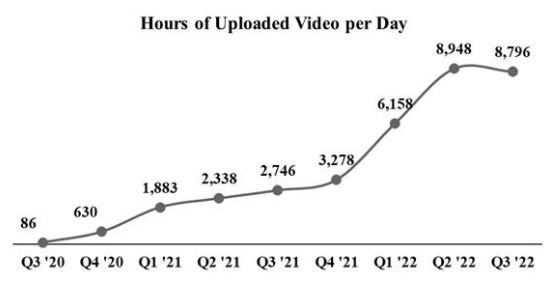

In terms of minutes watched and video uploads there are similar increases:

For comparison, YouTube has 30,000+ of hours uploaded per hour — or 70-80x the volume of content.

In terms of minutes watched, our prior calculations had YouTube users watching >1800B minutes / month[1] — or 0.55% of Rumbles viewership.

That said, Google’s Q3 2022 10-Q had a revenue for YouTube at $7.2B, implying Rumble has 0.15% of the revenue of YouTube.

User Growth – 2023

With that in mind, how has it gone since 2022? A plethora of people create locals.com and exclusive Rumble content, including:

January Exclusives: Glenn Greenwald, Donald Trump Jr, Redacted News, Dave Rubin, Rekieta Law, Kim Iversen,

February Exclusives: Kimberly Guilfoyle, Power Slap

March Exclusives: Steven Crowder, Scott Adams

Importantly, the subscriptions are starting — with Steven Crowder having over 58,000 presale paying subscribers. Rumble also launched a pay-per-view comedy special (which implies more such content). Monthly subscriptions were officially rolled out March 28.

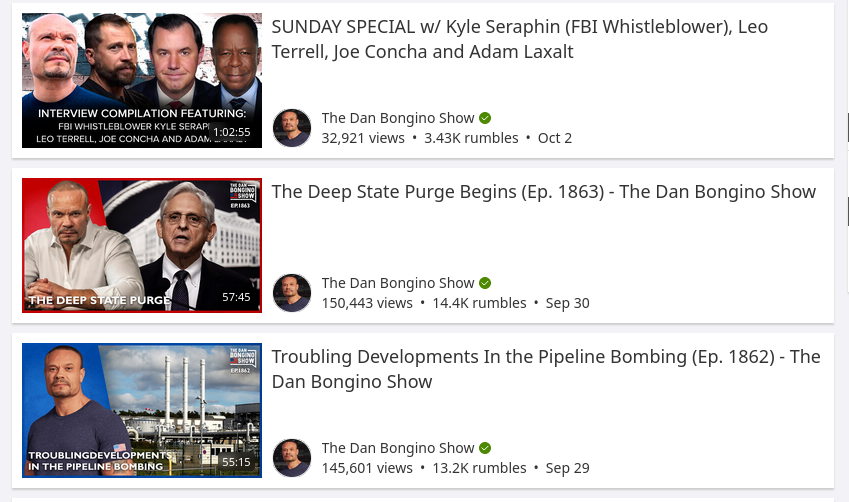

Combined with the exclusives, it appears to have a lead to a dramatic rise in overall viewership. In way of example, in October 2022 Dan Bongino, who is not exclusive to Rumble, had an average of around 150,000 views per video. See wayback machine on October 3, 2022:

Today, March 29 videos are averaging in the 600-1.2m view range. See wayback machine on March 29, 2022:

Today, March 29 videos are averaging in the 600-1.2m view range. See wayback machine on March 29, 2022:

The viewership of Dan Bongino is at least 4x-10x in that time frame. Given those figures would not be hard to imagine an increase of 2x to the total monthly active users since Q3 2022 on Rumble. Further, with the launch of subscriptions, it seems far more likely content providers will push their users onto Rumble and Rumble will see increased revenue from said subscriptions (which I suggested was a winning combo in my prior analysis)

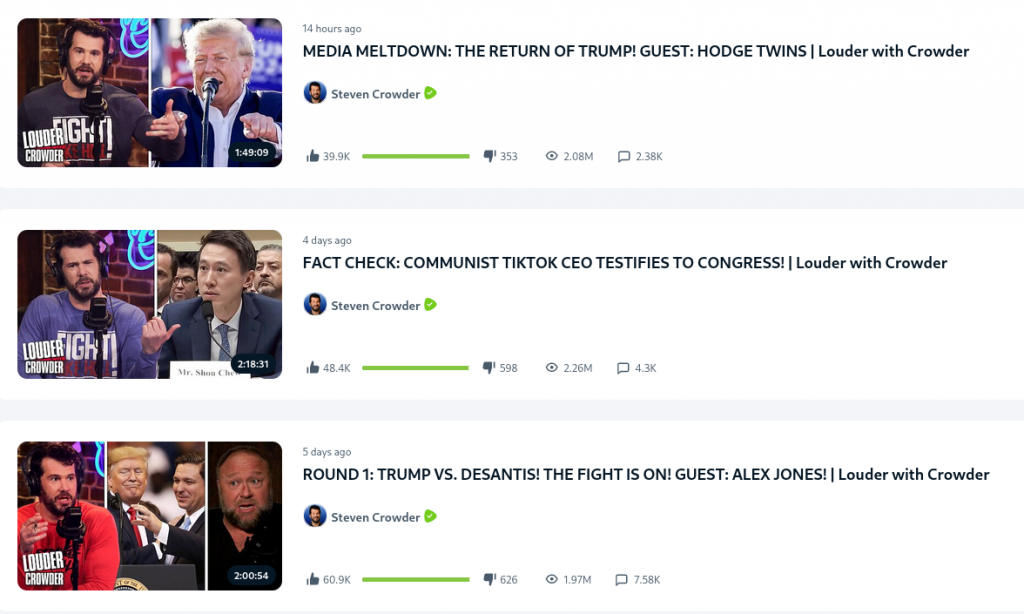

Finally, Steven Crowder, who just launched a couple weeks ago, appears to be averaging 2m views per video (see wayback machine):

Assuming he can translate (within a few months) to 100,000 subscribers at the $90.00 / year he’s charging, that would translate to $1m revenue alone to Rumble (who owns locals and charges 10% as a platform fee — though that may be waived in his case).

Assuming he can translate (within a few months) to 100,000 subscribers at the $90.00 / year he’s charging, that would translate to $1m revenue alone to Rumble (who owns locals and charges 10% as a platform fee — though that may be waived in his case).

Conclusions

Since my prior analysis, I suspect Rumble is now nearing 1% of YouTube’s viewership numbers and can easily imagine a 4x increase in monthly viewers (to 300m / month). Further, landing several large names, particularly Steven Crowder, will enable a rapid expansion as people view related content. Steven Crowder appeals to appeal to the key demo and is comedic — it will likely spur the expansion outside political commentary (though Steven Crowder does primarily focus on politics).

When discussing ad revenue this will dramatically help Rumble as a concentration of more view hours spent in one space & more concentrated users should enable higher bids for ads. Further, and as mentioned previously, Rumble appears to be targeting subscriptions earlier and more aggressively than Google did with YouTube. Based on the number of users with Locals it seems likely there are at least a few million Locals users with hundreds of thousands paying (resulting in several million in revenue). Locals.com is very similar and designed to compete with Patreon.

Finally, there’s a presidential election cycle coming up and Rumble primarily hosts political content (for now). It seems likely that if YouTube, Facebook, etc attempt to censor, Rumble will be able to take advantage and grow even more rapidly (due to their anti-censorship stance). If Rumble can grow non-political content over the next 12-18 months prior to that election cycle, they can likely maintain some users after the cycle interested in other genres of content.

I personally see Rumble exceeding 1.25% of YouTubes minutes watched by the end of 2023 and 2.5-5% of YouTubes minutes watched by the end of 2024.

To put it in perspective, if we assume that translates to even 1% of YouTube’s revenue, you’re looking at $300m/year in revenue by 2023-2024 ( $7.2B/quarter x 0.01 x 4 = $288M).